Seeking to propel your business forward? A well-structured capital infusion can be the driving force to unlocking significant growth. Whether you're aiming to grow operations, invest in new assets, or simply shore up your financial position, a business loan can provide the resources needed to realize your entrepreneurial visions.

- Discover the perks of leveraging business loans to fuel your growth.

- Understand the diverse of loan types available to align with your unique business needs.

- Uncover the procedure involved in acquiring a business loan and equip yourself for a seamless application process.

A Business Line of Credit

A line of credit provides a versatile funding source for your business requirements. Unlike traditional financing, a line of credit allows you to borrow {funds{ as needed, {paying interest only on the amount you actually use. This constitutes it an ideal tool for managing fluctuating cash flow.

- A line of credit may be applied to a variety of business activities, including payroll expenses, rent payments, accounts receivable financing

- Upon securing a line of credit, your business gains greater financial flexibility

Furthermore, lines of credit often come with competitive pricing options.

Merchant Cash Advance: Fast Capital for Immediate Growth

Businesses deserve capital to succeed. Sometimes, traditional financing options demand too long to process. This is where a merchant cash advance appears in handy. It's a immediate way for businesses to receive the funds they need to expand their operations and reach their aspirations.

A merchant cash advance is a temporary funding solution where a business receives an upfront sum based on its projected credit card sales. The funds are returned over time through a percentage of daily sales transactions. This system can be a beneficial tool for businesses that need fast funding.

One advantage of a merchant cash advance is its speed. Businesses can often receive money within a limited days, allowing them to address urgent demands. Additionally, the repayment structure is flexible, as it connects directly to sales volume. This means that businesses only settle when they are earning revenue. {

Small Business Loans for Small Businesses

The Small Business Administration (SBA) offers a variety of government-backed programs designed to assist small businesses in securing the resources they need to succeed. These financing options provide entrepreneurs with access to competitive interest rates and tailored repayment terms. By means of SBA loans, small businesses can launch, create new jobs, and contribute to the overall economy.

- Various types of SBA loans are available to meet the unique needs of small companies.

- Entrepreneurs can apply for an SBA loan through banks.

- The SBA work with lenders to support a portion of the loan, mitigating risk for lenders and making loans more accessible to small businesses.

Securing Business Loans: A Comprehensive Guide

Navigating the landscape business loan of business financing can be a daunting task for founders. From selecting the right loan product to processing a viable application, there are numerous phases involved. This guide aims to assist you with the information needed to successfully traverse the process of obtaining a business loan.

A crucial first step is to carefully evaluate your financial needs. Consider factors such as operational expenses. Once you have a distinct understanding of your requirements, research different loan choices available in the market.

Common types of business loans include:

* Term Loans

* Lines of Credit

* SBA Loans

* Microloans

Each loan type has its own features, interest rates, and repayment conditions. Thoroughly review the details of each loan offer to ensure you comprehend the complete implications before agreeing.

Remember, a well-prepared application is essential for maximizing your chances of loan approval. Gather all necessary files, such as financial statements, tax returns, and business plans.

Determining the Right Funding Option: Loans, Lines of Credit & More

Securing the appropriate funding for your business or personal/individual needs can be a crucial decision. There's a broad range of financing options available, each with its own benefits and weaknesses.

Grasping your specific requirements is the first step in choosing the right funding approach. Consider factors like the sum of financing you require, the intended purpose, and your willingness with different conditions.

Frequent funding channels include:

- Borrowing: Offer a lump quantity of capital to be returned over time with interest.

- Revolving Credit: Provide access to a specified sum of capital that you can draw upon as needed.

- Subsidies: Offer financialaid to support specific projects or ventures.

Seeking advice a financial advisor can be beneficial in assessing your alternatives and choosing the best funding plan for your situation.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Danny Pintauro Then & Now!

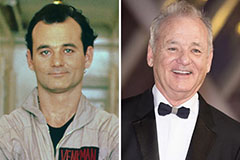

Danny Pintauro Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!